Your account security is important to us, so we've created an enhanced registration process to further protect your account information. Beginning February 24, 2020, you’ll need to re-register so you can set up some additional security features:

Individuals

I have a retirement plan. How can I change my investment allocations?

You may change your investments in one of three ways:

- Read More

You may change your investments in one of three ways:

- Reinvest all or a part of your money: This option allows you to exchange assets from one investment vehicle to another (one to one or one to many)

- Change how things are balanced now: This option allows you to rebalance all assets into one or multiple investment vehicles within the plan (many to many, many to one, one to many, one to one)

- Change where your contributions go in the future: This option allows you to change your future investment elections. This change only applies to new contributions made to your account.

- Tax form questions:

Form 1099-R is used to report the distribution of retirement benefits from an account. If applicable, these forms are sent to participants by January 31 each year.

Form 5498 is used for reporting regular or rollover contributions and value of an IRA, Roth IRA, ESAs, SEP, or SIMPLE IRA. This form does not need to be filed with the owner's Tax Return (1040) - it simply needs to be reported. Security Benefit is only required to notify IRA, Roth IRA, ESA, SEP and SIMPLE IRA owners of their Fair Market Value. IRA contributions and rollovers are reported to the client by May 31 of each year. (The form is only issued if a contribution or rollover occurred during the year).

- Reinvest all or a part of your money: This option allows you to exchange assets from one investment vehicle to another (one to one or one to many)

I have a retirement plan. What are my options for taking a withdrawal?

You may model or request a withdrawal by selecting the Model a Withdrawal option on the Loans & Withdrawals tab.

- Read More

You may model or request a withdrawal by selecting the Model a Withdrawal option on the Loans & Withdrawals tab.

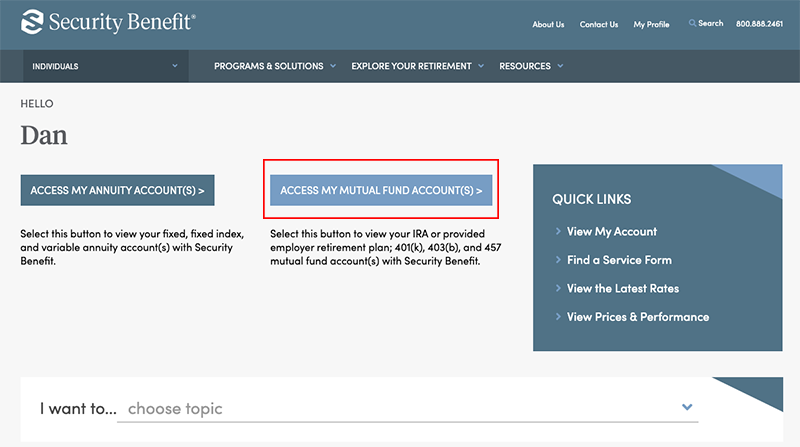

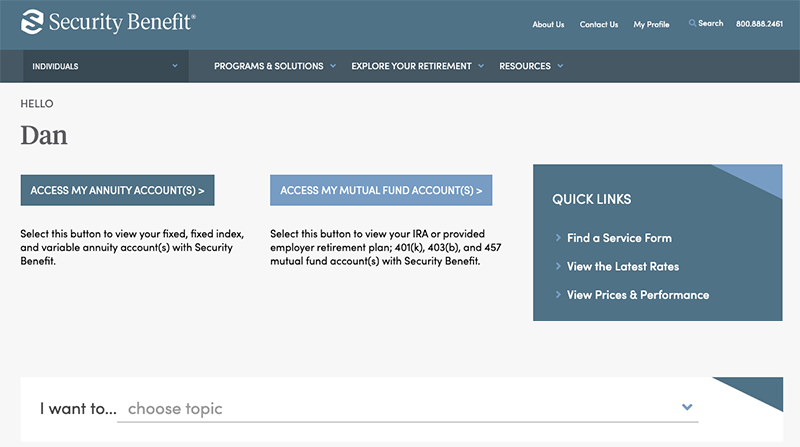

- Sign in to your account

- Select mutual funds option on dashboard

- Select the Loans & Withdrawals tab

The dollar amounts and withdrawal reasons listed on this page are subject to change based on your specific retirement plan provisions. Please contact your financial representative or our Service Center at 800.747.3942 to discuss your withdrawal options further.

- Sign in to your account

What is multi-factor authentication?

Security Benefit requires multi-factor authentication (MFA) to help protect your online account by requiring a verification code entered by you before accessing your account from an unknown device. You are in charge of deciding how to receive your verification code whether it be by text mess

- Read More

Security Benefit requires multi-factor authentication (MFA) to help protect your online account by requiring a verification code entered by you before accessing your account from an unknown device. You are in charge of deciding how to receive your verification code whether it be by text message, email or voice call. Once you receive your verification code, enter it when asked to gain access to your account.

Security Benefit requires MFA to help protect your online account by:

- Establishing a password.

- Establishing a verification method (how you’d like to verify your sign on: text, email or call back). We recommend setting up more than one method.

When you sign in to SecurityBenefit.com with your username and password, you will then be asked to have a verification code sent by text, email or call back depending on the options you selected during your account set up.

- Establishing a password.

Re-Register & Sign In

You have been redirected from SecurityRetirement.com to SecurityBenefit.com so you can begin using our new, more secure account sign in process.

What if I already have an online account on SecurityBenefit.com?

If you have a pre-existing account on SecurityBenefit.com you do not need to register.

If you have a pre-existing account on SecurityBenefit.com you do not need to register.

I have a retirement plan. When will I receive my 1099-R?

Form 1099-R is used to report the distribution of retirement benefits from an account. If applicable, this form is sent to retirement plan participants by January 31 each year.

- Read More

Form 1099-R is used to report the distribution of retirement benefits from an account. If applicable, this form is sent to retirement plan participants by January 31 each year.

I have a retirement plan. When will I receive my 5498?

Form 5498 is used for reporting regular or rollover contributions and value of an IRA, Roth IRA, ESAs, SEP, or SIMPLE IRA. This form does not need to be filed with the owner's Tax Return (1040) - it simply needs to be reported.

- Read More

Form 5498 is used for reporting regular or rollover contributions and value of an IRA, Roth IRA, ESAs, SEP, or SIMPLE IRA. This form does not need to be filed with the owner's Tax Return (1040) - it simply needs to be reported.

Security Benefit is only required to notify IRA, Roth IRA, ESA, SEP and SIMPLE IRA owners of their Fair Market Value. IRA contributions and rollovers are reported to the client by May 31 of each year. The form is only issued if a contribution or rollover occurred during the year.