Individuals

Tax Center

I have a retirement plan. When will I receive my 1099-R?

Form 1099-R is used to report the distribution of retirement benefits from an account. If applicable, this form is sent to retirement plan participants by January 31 each year.

- Read More

Form 1099-R is used to report the distribution of retirement benefits from an account. If applicable, this form is sent to retirement plan participants by January 31 each year.

I have a retirement plan. How can I change my investment allocations?

You may change your investments in one of three ways:

- Read More

You may change your investments in one of three ways:

- Reinvest all or a part of your money: This option allows you to exchange assets from one investment vehicle to another (one to one or one to many)

- Change how things are balanced now: This option allows you to rebalance all assets into one or multiple investment vehicles within the plan (many to many, many to one, one to many, one to one)

- Change where your contributions go in the future: This option allows you to change your future investment elections. This change only applies to new contributions made to your account.

- Tax form questions:

Form 1099-R is used to report the distribution of retirement benefits from an account. If applicable, these forms are sent to participants by January 31 each year.

Form 5498 is used for reporting regular or rollover contributions and value of an IRA, Roth IRA, ESAs, SEP, or SIMPLE IRA. This form does not need to be filed with the owner's Tax Return (1040) - it simply needs to be reported. Security Benefit is only required to notify IRA, Roth IRA, ESA, SEP and SIMPLE IRA owners of their Fair Market Value. IRA contributions and rollovers are reported to the client by May 31 of each year. (The form is only issued if a contribution or rollover occurred during the year).

- Reinvest all or a part of your money: This option allows you to exchange assets from one investment vehicle to another (one to one or one to many)

I have a retirement plan. What are my options for taking a withdrawal?

You may model or request a withdrawal by selecting the Model a Withdrawal option on the Loans & Withdrawals tab.

- Read More

You may model or request a withdrawal by selecting the Model a Withdrawal option on the Loans & Withdrawals tab.

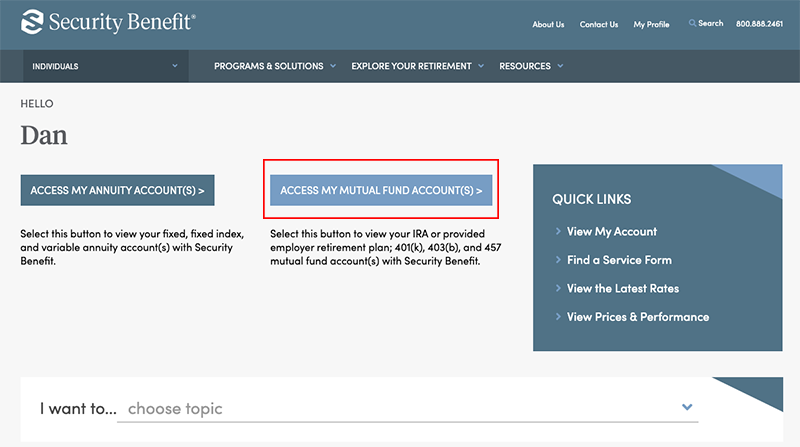

- Sign in to your account

- Select mutual funds option on dashboard

- Select the Loans & Withdrawals tab

The dollar amounts and withdrawal reasons listed on this page are subject to change based on your specific retirement plan provisions. Please contact your financial representative or our Service Center at 800.747.3942 to discuss your withdrawal options further.

- Sign in to your account

Temporarily Unavailable

The page that you're trying to reach is having technical difficulties and is currently unavailabl

The page that you're trying to reach is having technical difficulties and is currently unavailabl

5 Easy Ways to Slash Your Debt

Your money is more than dollar signs and decimal points. It’s your chance to buy a bigger home, take that dream vacation, or have the retirement you want.

Health Information Notice

Effective Date: April 14, 2004

Last Updated: September 1, 2018

THIS NOTICE DESCRIBES HOW HEALTH INFORMATION ABOUT YOU MAY BE USED AND DISCLOSED, AND HOW YOU CAN GET ACCESS TO THIS INFORMATION. PLEASE REVIEW IT CAREFULLY.

California Consumer Privacy Act (CCPA)

California Residents: Your privacy rights under the California Consumer Privacy Act (CCPA)

Effective Date: November 16, 2023

This California Consumer Privacy Act Disclosure explains how Security Benefit Life Insurance Company, Security Benefit Corporation, Security Distributors, L

I have a retirement plan. What are my options for taking a loan?

You may model or request a loan by selecting the Model a Withdrawal option on the Loans & Withdrawals tab.

- Read More

You may model or request a loan by selecting the Model a Withdrawal option on the Loans & Withdrawals tab.

- Sign in to your Security Benefit account

- Access your accounts on the dashboard

- Select the Loans & Withdrawals tab

Enter your desired loan type, loan amount, payment frequency and payment choice. Please contact your financial representative or our Service Center at 800.747.3942 to discuss your loan options further.

- Sign in to your Security Benefit account