Security Benefit today announced the addition of index accounts based on three new indices to its flagship fixed index annuity (FIA), Foundations Annuity. The new indices represent international, technology, and small cap segments, as well as a simple Trigger Rate strategy benchmarked against the S&P 500®. With these new options, Foundations now features 15 different index-linked accounts featuring equities, bonds, commodities, and Treasury asset classes that allow advisors to align with their economic and market outlook.

“More asset classes means more ways to mirror your managed money strategies within the safety of an FIA,” said Toby Leonard, AVP, Product Development at Security Benefit. “Diversification is key to a client’s long-term asset mix. With Foundations, advisors can derisk portfolios by taking market loss off the table, allow for tax-deferred accumulation, and prepare for multiple scenarios with a protection-based product.”

The global economic environment appears stable, though near-term risks remain. However, current trends could drive accelerated growth in markets over time: artificial intelligence, data center build-outs, reshoring of manufacturing, pharmaceutical development, space programs, and more. To tap into this long-term potential, Security Benefit added index accounts based on three well-known indices, each featuring an Annual Point to Point Index Account with a Cap:

MSCI EAFE

The MSCI EAFE Index is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the US and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

Nasdaq-100®

The Nasdaq-100 Index (NDX®) represents 100 of the largest, most dynamic non-financial companies listed on the Nasdaq Stock Market and some of the most innovative companies in the world. These companies are selected based on market capitalization and are renowned for their innovation, market leadership, and growth potential. NDX includes major players across various sectors such as technology, healthcare, consumer goods, and industrials, making it a comprehensive benchmark for growth-focused investors.

Russell 2000® Small Cap

The Russell 2000® Index measures the performance of the small-cap segment of the US equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 7% of the total market capitalization of that index, as of the most recent reconstitution. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership.

Trigger Rate Strategy*

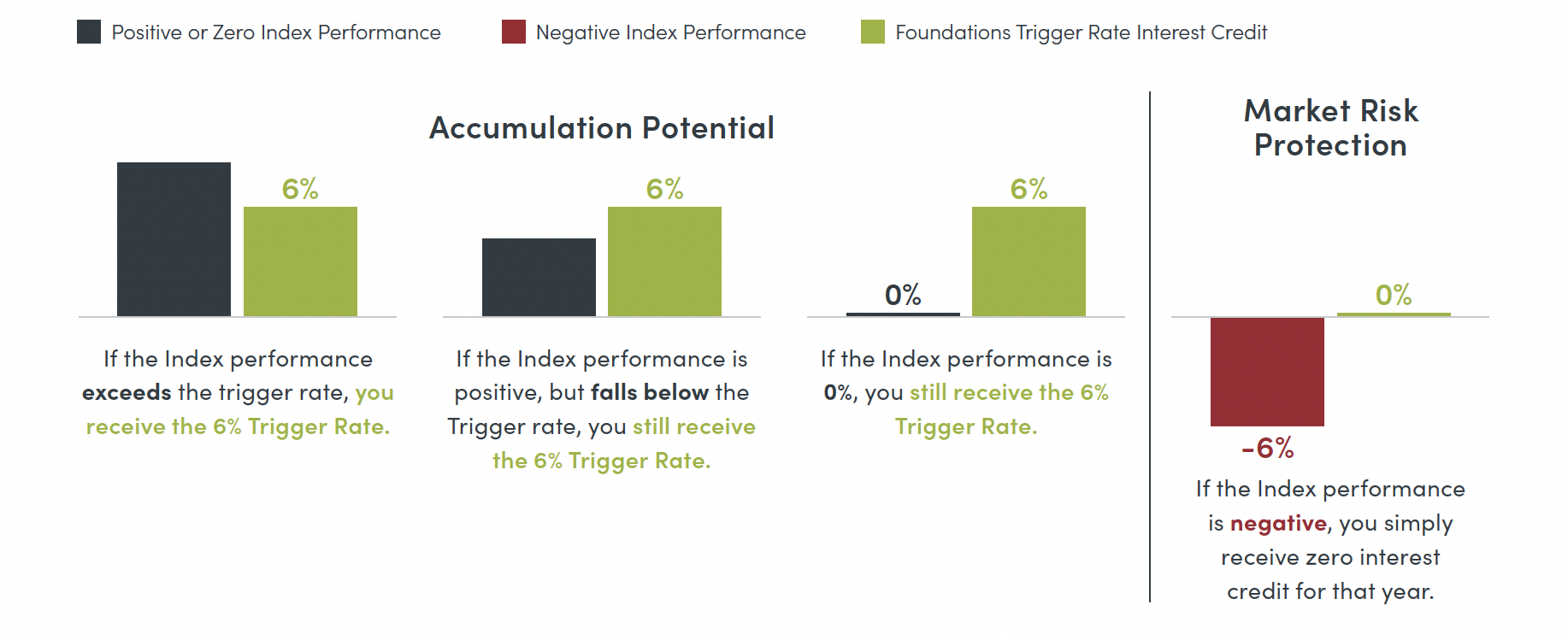

Additionally, Security Benefit has added a straightforward crediting strategy for clients benchmarked against the S&P 500. With the new Annual Point to Point Trigger Rate strategy, a Trigger Rate is established at term (6% is used as an example below), and Index performance of 0% or higher credits the stated Trigger rate.

“Now, with the addition of these four new strategies, advisors have more asset classes from which to diversify clients’ allocations within Foundations, with none of the associated market risk,” added Leonard.

For more information: SecurityBenefit.com/Diversify