Market downturns can feel like a blow to your financial confidence — sudden, unpredictable, and often beyond your control. But what if the key to investing isn’t just about avoiding the dips, but rather learning how to mitigate their impact? Defeating the downside means understanding the history behind bear markets, making informed portfolio decisions, and employing protective strategies to secure your future. With the right plans in place, you can approach the next drop not with fear but with confidence.

What the Market Has Done Over Time

Market downturns are an unavoidable part of investing. Whether triggered by economic shifts, global events, or investor sentiment, these declines can take a toll on your portfolio—and your peace of mind. Some recoveries are swift, while others take time, testing both patience and strategy. Yet history shows a consistent pattern: equity markets eventually rebound and reach new highs. The question isn’t if markets will recover, but how long it will take—and how prepared you are to overcome such market volatility. Will you defeat the downside?

A Brief History of Market Crashes

Stock market drops aren't new — and they’re not permanent.

- 1929: The Great Depression – Sparked by rampant speculation and poor regulation, the market lost nearly 90% of its value from its peak. It took years to recover, but eventually, the market did bounce back and sparked a long-term era of economic expansion.

- 1987: Black Monday – In a single day, markets plunged 22%. Panic ensued, but the economy remained stable, and the market recovered in less than two years.

- 2000: The Dot-Com Bubble – Overvalued tech stocks collapsed, wiping out trillions. The market slowly recovered, paving the way for new industries and a housing boom.

- 2008: The Financial Crisis – Caused largely by subprime mortgage lending, the market fell by over 50%. Yet, within five years, most indexes returned to pre-crash levels.

- 2020: COVID-19 Pandemic Crash – A sharp, sudden drop saw the market lose 34% in just a month. Still, it turned into one of the fastest recoveries in history.

| Historical Stock Market Crashes | Market Repercussions | ||||

| Beginning Date | Drawdown Percent | First Day to Reach Previous Market High | Market Performance - Since Drawdown | Number of Days to Recovery | |

| 1970 - Double Bottom Bear | 1/20/1970 | -20.9% | 3/6/1972 | 26.93% | 757 |

| 1987 - Black Monday | 10/19/1987 | -33.2% | 7/26/1989 | 50.35% | 646 |

| 2001 - The Dot-com Bubble | 3/12/2001 | -22.7% | 5/30/2007 | 29.66% | 2,270 |

| 2008 - The Financial Crisis | 7/9/2008 | -20.5% | 3/28/2013 | 26.07% | 1,723 |

| 2020 - COVID-19 Pandemic Crash | 3/12/2020 | -26.7% | 8/18/2020 | 36.65% | 159 |

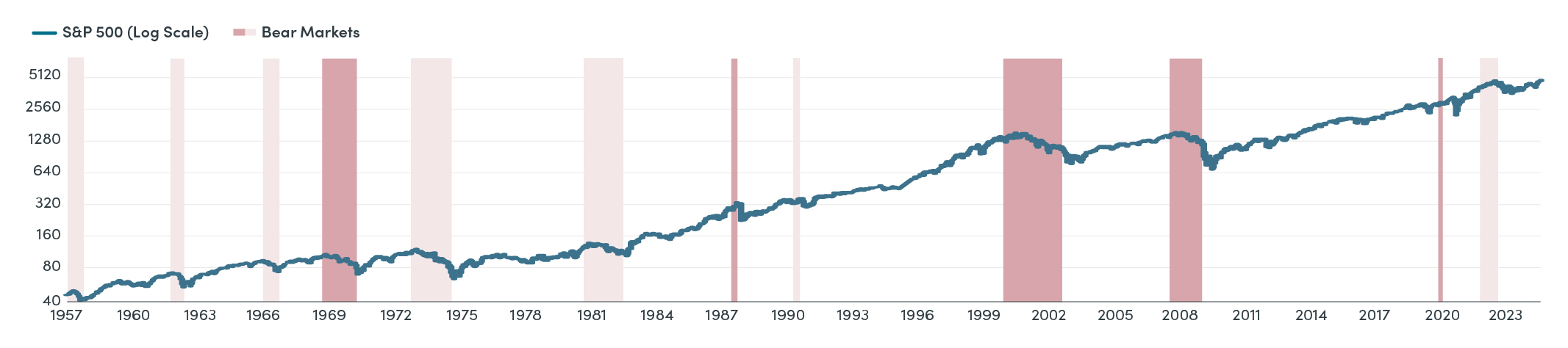

A Closer Look: Bear Markets Through the Years

While dramatic crashes make headlines, bear markets — defined as a decline of 20% or more from recent highs — are a normal part of the investing cycle. They may feel alarming in the moment, but history shows they’re temporary setbacks, not permanent losses.

Bear markets have happened in the S&P 500 12 times since the index expanded to include 500 stocks in 1957.1

Take Control

Historically, the average recovery time from a major market downturn is about two years, depending on the severity of the crisis. After the 1929 crash, it took 25 years for the Dow to reclaim its previous high. Meanwhile, markets recovered from the 2020 COVID-19 crash in just five months. Staying the course, even when it’s uncomfortable, has proven to be a winning strategy for long-term investors.

But not everyone has the luxury of time.

Avoiding the Downside

For retirees or those nearing retirement, a sudden drop could derail years of careful planning. That’s where diversification — and safer alternatives — can make all the difference.

Balancing Growth and Safety

- Diversify your investments – Mix different asset classes (stocks, bonds, annuities, etc.) to spread out risk and reduce overall volatility.

- Add protection to your portfolio - Explore options such as fixed annuities that can preserve your principal while still supporting growth.

- Revisit your timeline – If your retirement plans or financial situation have changed, adjust your investment strategy accordingly.

- Align investments with goals – Make sure your portfolio reflects your current long-term objectives, not just past assumptions.

- Rebalance regularly – Shift allocations between stocks, bonds, and other assets as needed to maintain your desired level of risk.

- Accept that diversification isn’t a guarantee – It won’t eliminate losses, but it can help soften the blow during market downturns.

Non-correlated asset classes with no ties to market performance, such as fixed and fixed index annuities, can be an option for protecting your savings while providing interest potential too. Such annuities are strong examples of safe money solutions that can be used to diversify traditional asset classes.

Fixed and fixed index annuities provide:

- Tax deferral

- Guarantees against the loss of principal due to market downturns.

- The potential for credited interest

- And the reassurance of a death benefit for beneficiaries.

You don’t have to fear the next market downturn. By diversifying your portfolio, adjusting to your financial goals, and using protective strategies like fixed annuities, you can take control of your financial future. Defeating the Downside isn’t about avoiding every twist and turn — it’s about building a plan that keeps you moving forward, no matter what the market throws your way. When you’re prepared, even the downsides can’t hold you back.

Connect with a financial advisor today to review your strategy, explore protection options, and start building a plan that puts you in control — no matter where the market goes next.

Your path To and Through Retirement® begins here.

Talk to your financial professional to learn more or contact us at 800.888.2461

1 Brittanica.com/topic/SanP-500

Additional Topics

How Do the Fed's Interest Rate Moves Impact Your Wallet?When markets are in flux and rates are declining, it can feel overwhelming. Understanding interest rate activity in the market, and projected trends can help you make informed decisions and explore savings vehicles that are right for you. |

How Can You Extend the Benefits of an Inherited IRA?When you carefully plan who will inherit your IRA, your beneficiaries may be able to continue growing the funds tax-deferred and create generational wealth. |