Below are materials that help explain Foundations Annuity and offer hypothetical index account performance.

Resources for Clients

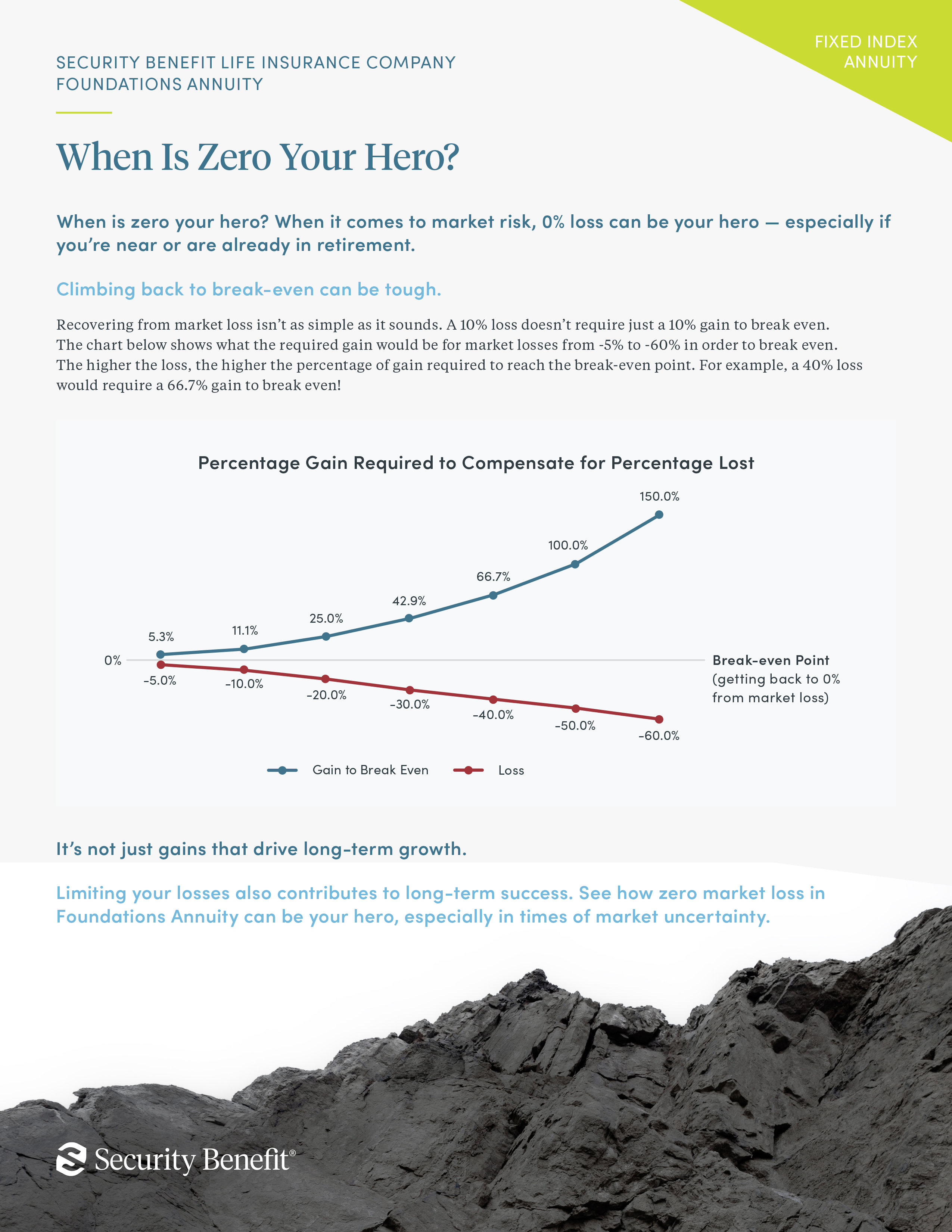

| When Is Zero Your Hero?Help your clients understand the advantages of zero market risk in Foundations by reviewing hypothetical interest credits for each of the Annual Point to Point index accounts within Foundations. | |

| Locking In Interest PotentialThis overview offers clients an easy-to-understand example of how a Foundations contract can accumulate while remaining protected over time. |

Resources for Advisors

| Index Comparison Guide (FPUO)A range of crediting strategies can spread out your clients potential for accumulation. This guide provides a snapshot of all benchmarked indices within Foundations, as well as the crediting strategies associated with each. |

Connect with our sales team to access our complete resource library!

Selling Foundations

| 1. Check with Broker-Dealer to see if Foundations is approved. |

| 2. Get Appointed with Security Benefit |

| 3. Complete Product Training |