Option 1

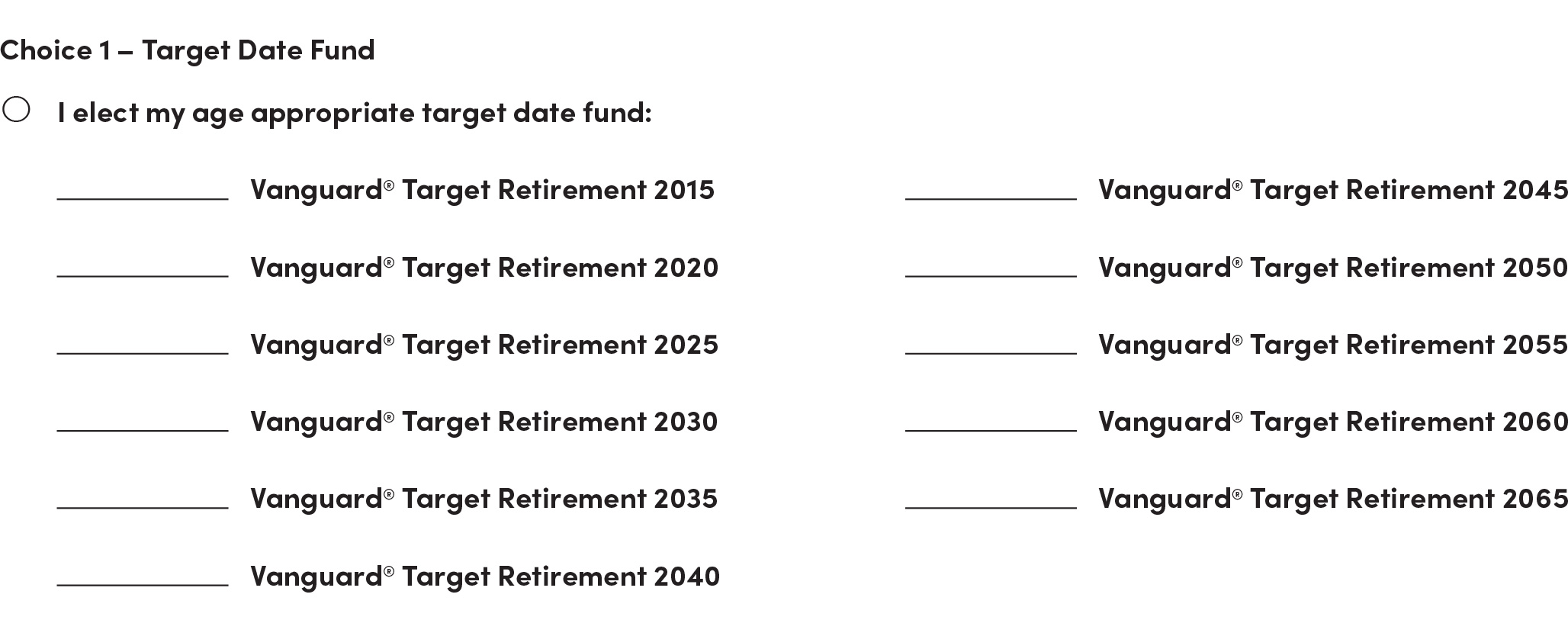

Choose a Vanguard Target Date Fund

The Target Date would be the date closest to the date that you think you will retire.

Option 2

- Take the Risk Quiz

- Choose a model that is closest to your risk score

- Choose a portfolio with Vanguard Core Index Funds that fits the score from your quiz

*The Fixed Account Option is a group unallocated fixed annuity contract issued by Security Benefit Life Insurance Company (SBL), policy form GV4586 (12-03)U. The group fixed annuity is not available in all states.

Option 3

Build your own portfolio with our diverse platform of mutual funds from multiple investment managers