What It Is: A predictive tool created to measure the expectations of Registered Investment Advisors (RIAs) for the upcoming year's economy and market movements.

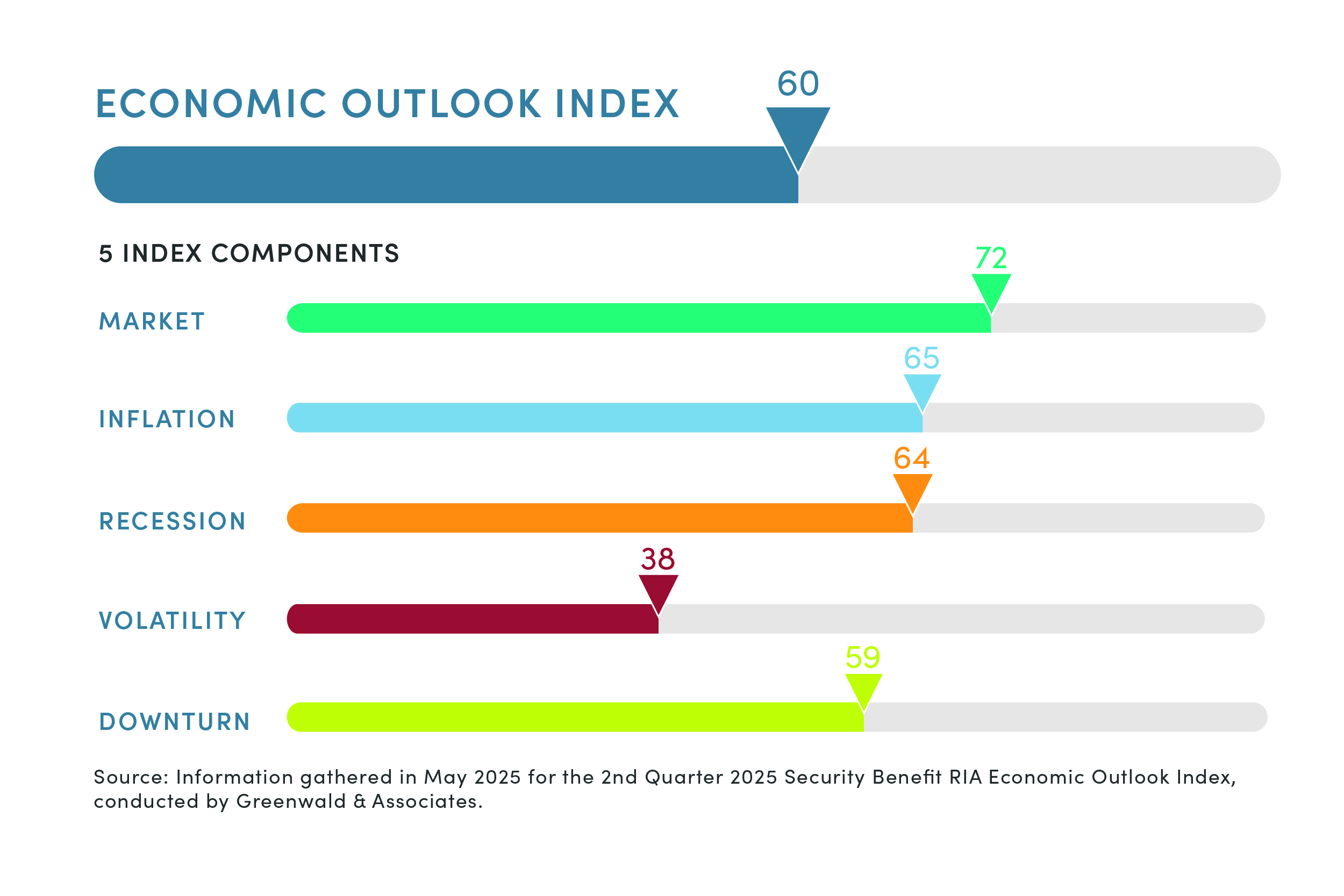

How It Works: The index is based on responses to five critical questions related to key economic indicators such as the S&P 500 performance, inflation rates, recession probability, market volatility, and potential equity market downturns from over 100 RIAs around the country.

Key Insights

- Index Score and Sentiment: Advisor confidence is on the rise this quarter, with the overall index moving up to 60. Hybrid RIAs continue to lead in optimism with a score of 64, while pure RIAs follow at 56. The mood is improving, and most advisors seem to feel good about where things are headed, even if they’re staying a little cautious.

- Market Performance: About 59% of RIAs expect the S&P 500 to grow between 6% and 9% over the next year. That’s in line with last quarter, showing a steady belief that the market still has room to grow.

- Inflation Expectations: Expectations around inflation have shifted in a big way.60% of advisors now think inflation will stay below 3% over the next year, which is a big jump from where things stood last quarter. It’s a sign that more advisors believe inflation is settling down.

- Recession Probability: Concern about a potential recession is starting to come back. 45% of RIAs now say there’s at least a moderate chance of a recession in the next year, which is up from 29% last quarter. Even with that shift, the overall outlook is still more positive than not.

- Volatility and Downturn Concerns: Just over half of RIAs, about 56%, expect market volatility to increase this year. That’s actually a little lower than what we saw last quarter. Fewer advisors are worried about a major downturn too, with only 13% saying they’re very or extremely concerned. Most are staying alert but not overly anxious.

Why It Matters:

- Strategic Planning: Offers an early signal of potential economic shifts, aiding in better strategic planning for RIAs and their clients.

- Advisor and Client Confidence: Reflects a collective stance of cautious optimism, providing reassurance in the face of potential market challenges.

Download a visual overview of the RIA Economic Outlook Index, which measures Registered Investment Advisors’ (RIAs) economy and market trends expectations. |

Download the RIA Economic Outlook Overview, which provides insights into Registered Investment Advisors’ (RIAs) expectations on key economic factors, including market performance, inflation, and recession risks for the upcoming year. |