Your New Favorite FIA from Security Benefit

For LPL Advisors

Foundations Annuity - Your New Favorite FIA

Foundations Annuity is a straightforward, competitive FIA designed for you and your clients.

You have access to many FIA products, but you may be missing out on some great features if you haven't considered Foundations Annuity.

Our highly competitive rates and a 1% bonus on your client's first-year premium payments are just a few reasons why advisors love Foundations.

Select index account caps up to

10.50%

effective 09/15/2025

Guaranteed Fixed Account rates up to

4.75%

effective 09/15/2025

Guaranteed Fixed Account GMIR

2.80%

effective 07/01/2025

New in 2025 - More Ways to Diversify

We've expanded strategies, sectors, company sizes, and global markets! You can now choose a Trigger Rate strategy and strategies based on the MSCI EAFE International Index, Nasdaq-100®, and Russell 2000®.

New Trigger Rate Strategy Offers Simplicity

Simply put, if the S&P 500® performs at 0% or better, your client's contract is credited the stated Trigger Rate.

| Take a look at the strategy's 20-yr hypothetical performance and how the strategy works within Foundations.

|

More Asset Classes From Which To Choose

Learn more about each of the newest indices and the 20-yr hypothetical performance of their index accounts within Foundations.

Download MSCI EAFE (International Equities) Index Account At a Glance

Essential Foundations Resources

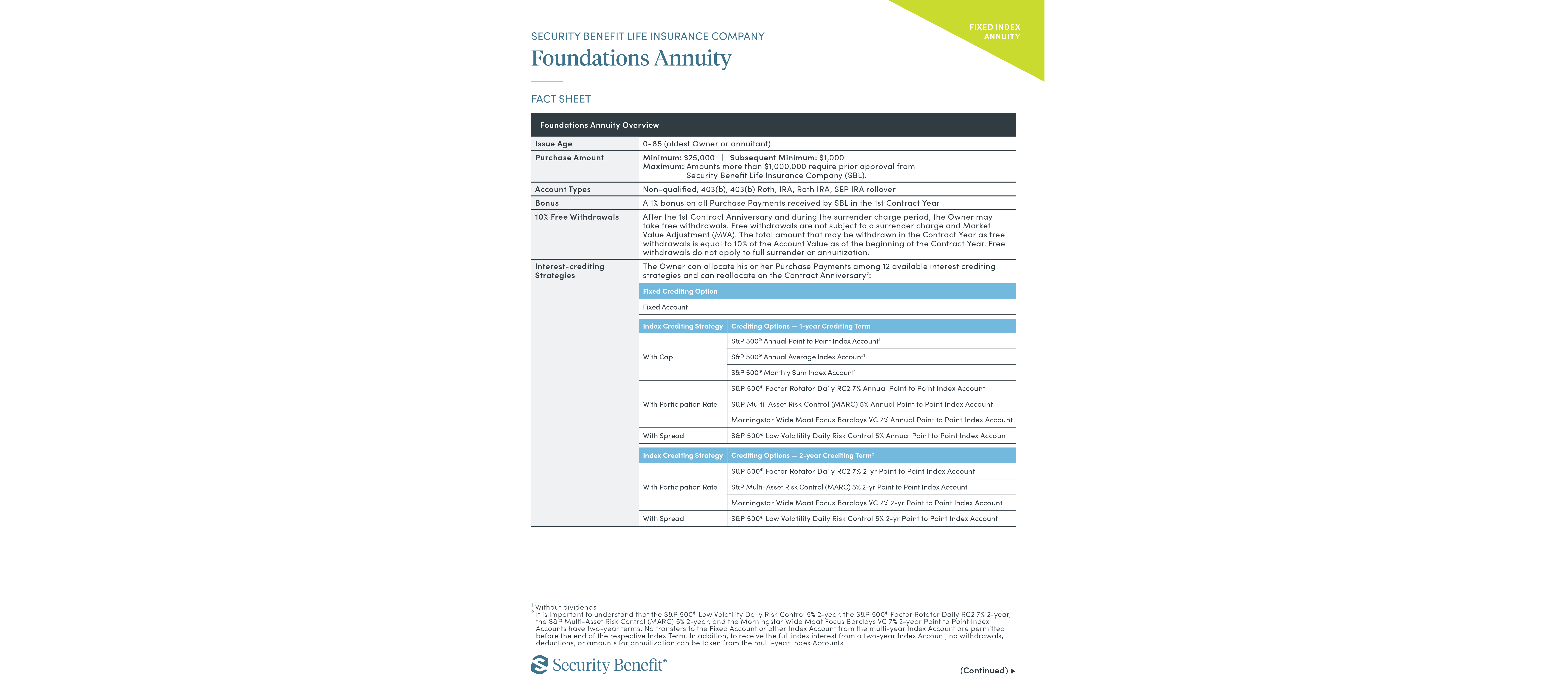

View our Foundations Fact Sheet for product details and commission schedule.

Read more about the competitive advantages Foundations can offer your clients. See why Foundations could be your new favorite FIA.

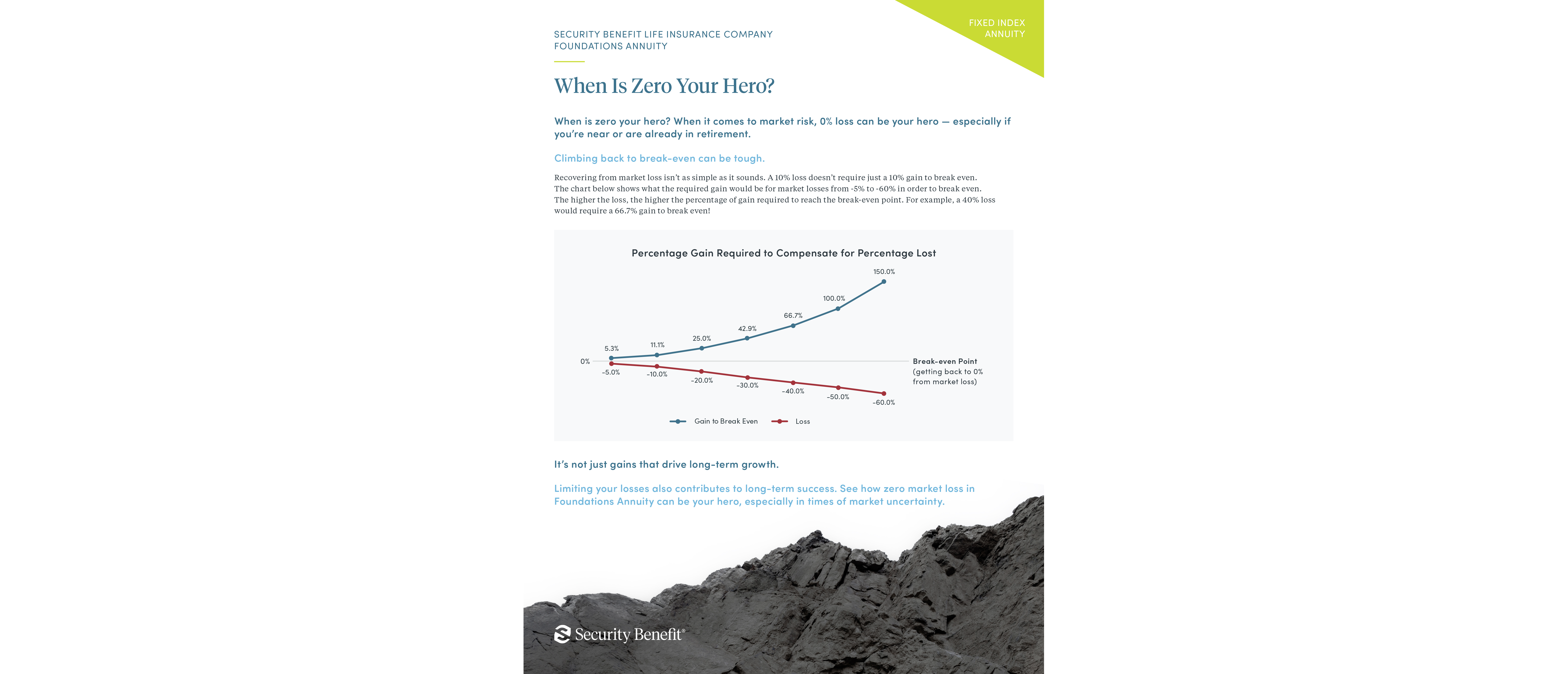

Help your clients understand the advantages of zero market risk in Foundations by reviewing hypothetical interest credits from each of the Annual Point to Point index accounts within Foundations.

Getting Started

You'll need to become appointed to sell Security Benefit's Fixed, Fixed Index, and Variable Annuities.

Once appointed, we'll send you a New Rep Onboarding kit to guide you through your first sale.

Keep in mind that before selling Foundations, you'll need to complete Foundations product training.

Your welcome email will include instructions on how to register for an account on SecurityBenefit.com, which will allow you to access your client accounts, order sales materials, and view rates, prices and performance.

We offer resources on Advertising Policies and Procedures, Anti-money Laundering Training and NAIC Suitability Model Requirements.

Follow our In Good Order Requirements to assure each new business application is complete and processed by us in a timely manner.

About Security Benefit

For more than five decades, we’ve focused our expertise solely on the retirement market, providing a broad suite of annuities and mutual fund programs to help customers align their assets with their aspirations.

Contact Us

We’re here to help your clients To and Through Retirement®.